Buying a new home, especially if it’s your first time, can seem like the great unknown. It’s also one of the most exciting decisions you will ever make! So, when it comes to deciding what loan program is right for you, know that you’ll have a great team working alongside you, every step of the way.

KBHS Home Loans mortgage officers are 100% dedicated to you, and your best interests. They are also well-versed in the unique dynamics of securing a new home loan. So, relax. You have a team of professionals to support you with guidance and knowledge.

What is the benefit to choosing KBHS Home Loans?

We know you have choices when it comes to selecting a lender. KBHS Home Loans is a fully integrated, dedicated lender for KB Home. As our affiliated home loan partner, KBHS Home Loans® understands our procedures and protocol, and is committed to keeping things moving along, and on track.

KBHS Home Loans has an excellent reputation for customer service. Their main goal? To ensure that your loan is ready to close when your home is completed. Their loan officers also know that communicating is important, and will contact you at least once a week with updates. They fully appreciate that there’s a learning curve when buying a first home, so don’t ever hesitate to call. If you have questions about your loan, KBHS Home Loans has answers.

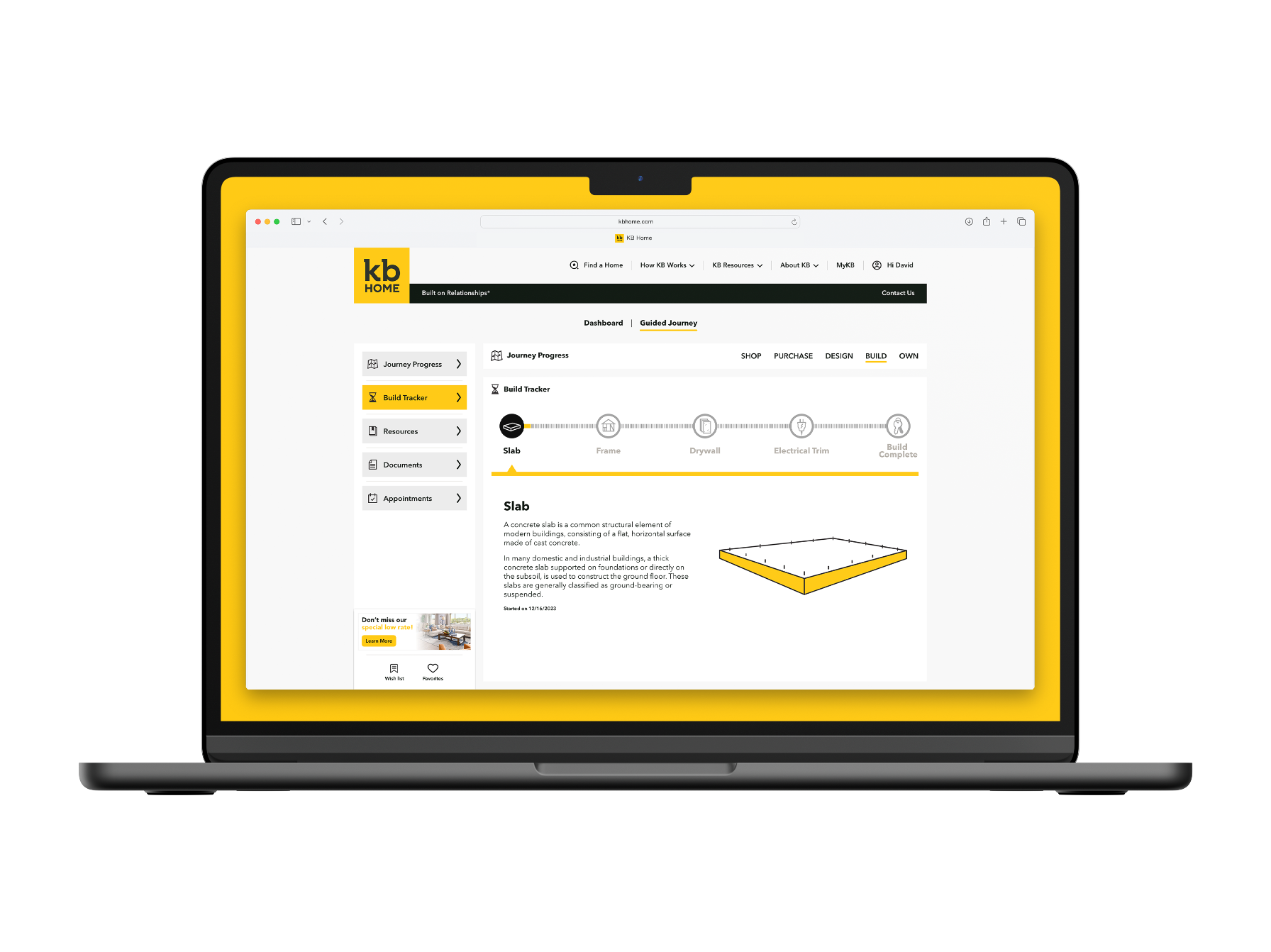

And there’s this. KBHS Home Loans and KB Home collaborate daily, and that’s a huge advantage for you. From framing to electrical and drywall, your loan officer is current on every construction stage of your new home. That means you don’t have to spend valuable time and resources coordinating between an outside lender and your homebuilder. KBHS Home Loans handles it.

Can I finance design choices through my home loan?

Let’s get to the good stuff, personalizing your new home at the KB Home Design Studio. You’ll be happy to know that your KBHS Home Loans loan officer works directly with your sales counselor upfront, to help you plan ahead and prequalify. That way, an estimate of studio options and floor plan preferences can be included in your mortgage. And you’re good to go.

How do I decide what loan is best?

KBHS Home Loans has hundreds of loan programs (we know, that sounds like a lot), but they are solely focused on helping you obtain a loan that works best for your unique financial situation. They offer competitive rates and exceptional service on conventional, government (FHA, VA and USDA) and jumbo fixed- and adjustable-rate mortgages.

Your dedicated loan officer understands that the loan process can be intimidating. That’s why they take a thoughtful, thorough approach to educate you, and to explain the different scenarios that can help you achieve your short-term and long-term financial goals.

There are lots of factors to consider. How long do you anticipate living in your new home? How much of a down payment can you comfortably afford? What is your desired price range? These very important questions help determine your financial capabilities and provide direction for your loan. The result? Securing a mortgage for your new KB home that accommodates your family’s personal budget, lifestyle and goals.

KBHS Home Loans customers enjoy state-of-the-art technology.

Every KBHS Home Loans customer has the advantage of world-class technology that delivers a seamless, secure experience. This digital platform helps expedite the process, and gives you the flexibility to handle essential transactions from your cell phone or home computer.

If you’re imagining a mountain of paperwork, imagine this. KBHS Home Loans offers a cutting-edge digital platform that is secure, protected and convenient. You have the ability to fill out your application online, upload required files, and allow financial documents to be submitted and accessed electronically from your bank or employer. Your KBHS Home Loans loan officer can also screen share in real time to help you complete any step of the mortgage process.

What is a hybrid closing?

Hybrid closings are available on most of our loan programs, and give you the convenience to securely review and electronically sign (e-Sign) documents from the comfort of home. Every KBHS Home Loans borrower has the flexibility of hybrid closing technology, which significantly reduces your time spent at the signing table. In fact, this process is so streamlined and efficient, it can take just 15 minutes when everything is good to go.

Of course, there are some critical documents that must be signed in the presence of a notary. This part of the process can also be accomplished from home, because KBHS Home Loans will send a mobile notary to your requested location.

Buying a new home is the largest financial commitment you will make in your lifetime. KBHS Home Loans is there to help you feel confident and informed, every step of the way.

‡According to data from https://fred.stlouisfed.org/graph/?g=1Qh9n

KBHS Home Loans, LLC NMLS 1542802 For licensing information visit nmlsconsumeraccess.org. Headquarters: 300 East Royal Lane, Suite 250, Irving, TX 75039. 855-378-6625. Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply. Equal Housing Lender. AZ: KBHS – 4949 Pioneer Ln, Lakeside, AZ 85929 – Mortgage Banker License #0939988; CA: Licensed by the Department of Financial Protection and Innovation Under the California Residential Mortgage Lending Act #41DBO-67718. California Financing Law License #60DBO-67717; CO: Regulated by the Colorado Division of Real Estate; WA: Washington Consumer Loan Company License #CL-1542802.

KB Home and KBHS share common ownership and because of this relationship may receive a financial or other benefit. You are not required to use KBHS as a condition of purchase or sale of any real estate.